T2200S forms will be shared via Google Drive today

To: All employees

As mentioned in our communication on February 10, 2021, the form T2200S - Declaration of Conditions of Employment for Working at Home Due to COVID-19 is being prepared for everyone who was employed at Ryerson University between March 16 and December 31, 2020.

These forms are now available and will be shared with you via Google Drive later today.

How it will appear in your email

You will receive an email from “Ryerson Financial Services” with the subject line “Your T2200S form”.

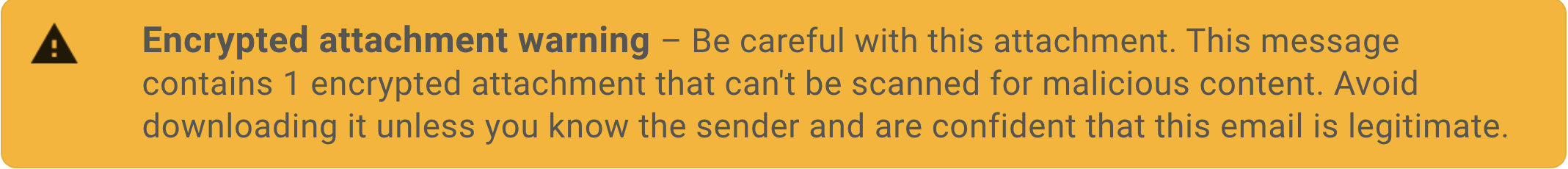

Your form has been encrypted for added security. Your email may display a warning:

How to download your form

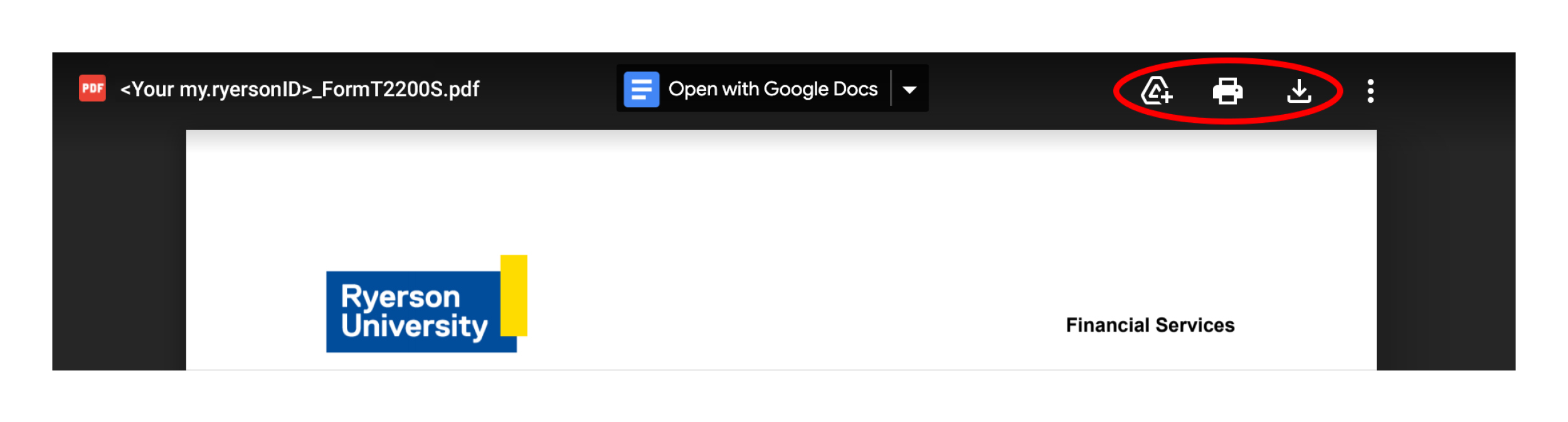

Please click on the link in the email to preview your form. It should appear as:

<Your my.ryersonID>_FormT2200S.pdf.

Using the icons at the top right, you can add a shortcut to your drive, print or download your form.

Who is eligible to make a claim using the T2200S?

Important note: Receiving this form does not confirm that you are eligible to make a claim on your personal income tax return.

According to the CRA, certain criteria must be met in order to be eligible to make a claim. KPMG, Ryerson’s accounting firm, has provided an (google doc) explainer resource document and FAQs on deductions of home office expenses (external link) to assist employees with understanding.

We recommend that you carefully review this information, and confirm your eligibility with a tax advisor.

The University does not take on any responsibility with respect to the decision of an employee to make a deduction on their tax return. This communication and all resource materials provided are not to be considered tax advice. Please consult your tax advisor.

Former employees

Those who worked at Ryerson between March 16 and December 31, 2020 but are no longer employed with Ryerson will need to contact Andrea Skyers at askyers@torontomu.ca to request their T2200S.

Troubleshooting

Please contact rufishelp@torontomu.ca if you have not received an email with your form by tomorrow or if you are having difficulty accessing your form.

Questions?

Please review the (google doc) Deduction of Home Office Expenses and FAQ (external link) .

Please also review the CRA website (external link) for more information.