The Accommodation and Food Industry: Labour Market Trends and Skills Needs

It is no secret that the accommodation and food industry was one of the hardest hit by the COVID-19 pandemic, and that the recovery of the sector has been stalled by severe worker shortages. More than 200,000 restaurant workers (external link) left the industry during the pandemic in pursuit of better wages, job security and a change of scenery in new industries. Supply chain issues also threaten Canadians' access to food supplies (external link) , adding even more challenges to an industry that is struggling to recover. As the demand returns, filling this gap has become a pressing need for the industry, and it will have to find innovative ways to attract those who have left, as well as new workers.

In this post, we examine the current labour market trends in the accommodation and food industry, which has been hurt badly by the pandemic, to see how the recovery phase might help to foreshadow what comes next. We then draw our attention to newcomers, who are key to aiding the recovery of the industry as they tend to be overrepresented in many of its occupations (external link) .

Labour Market Trends in the Accommodation and Food Industry

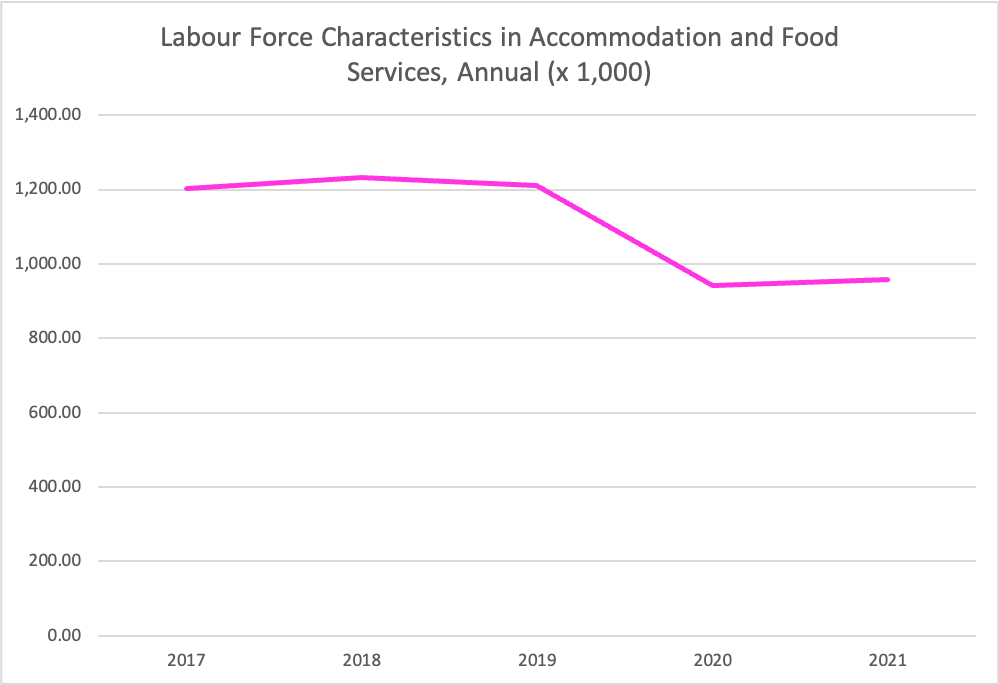

Statistics Canada’s (external link) analysis of the labour market shows the number of people working in the industry fell sharply from 1.2 million in 2019 to 942,000 in 2020. There were some signs of recovery in 2021 as employment rose to 958,000, but this number is still well below that of 2019.

Source: Statistics Canada. Table 14-10-0023-01 Labour force characteristics by industry, annual (x 1,000). https://doi.org/10.25318/1410002301-eng (external link)

Year |

Number of Workers |

|---|---|

2017 |

1201900 |

2018 |

1232100 |

2019 |

1209800 |

2021 |

941900 |

2021 |

957700 |

The industry is facing severe worker shortages. Recent survey findings from (external link) the (external link) Canadian Survey on Business Conditions (external link) during the second quarter of 2022 found that nearly two-thirds of businesses in accommodation and food services expected a shortage of labour, which was also the largest proportion across all sectors. Vacancies rose almost 40% in March 2022 from the previous month to 12.8%. This was the highest rate across all sectors for the 11th consecutive month.

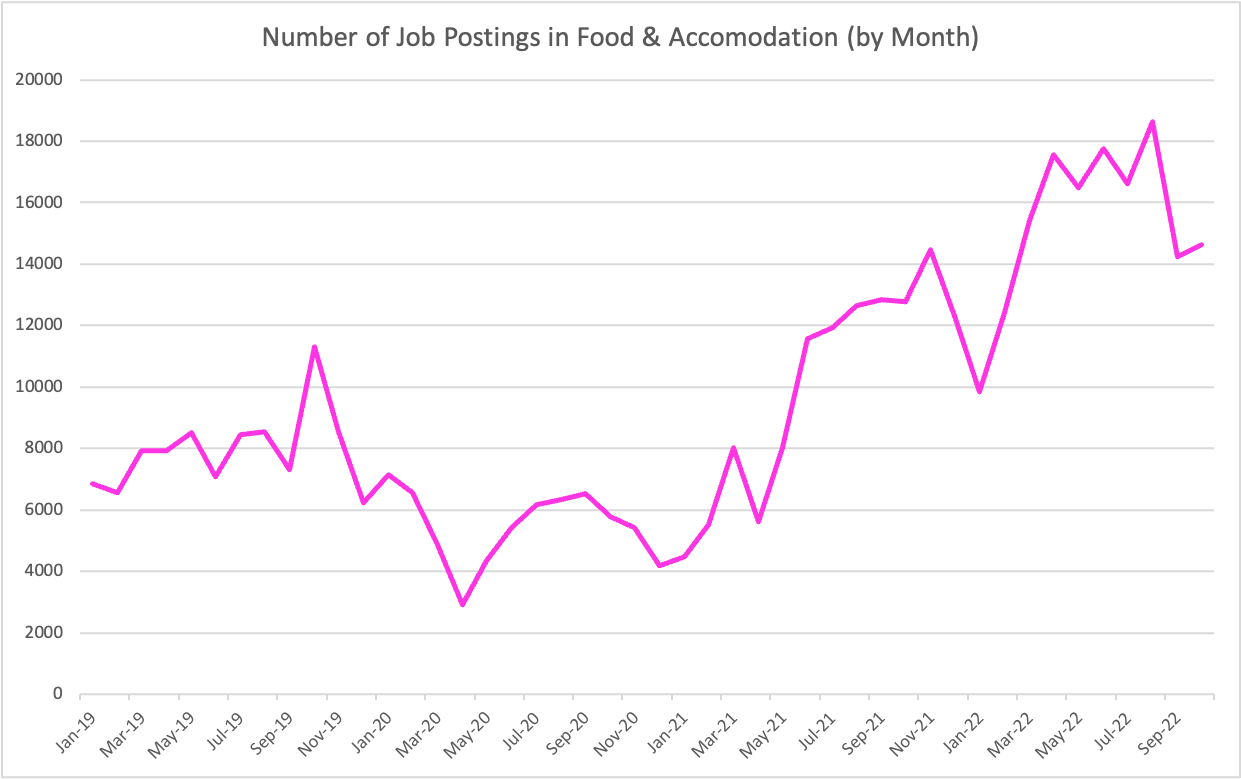

To complement the employment data from Statistics Canada, we used the Vicinity Jobs online job posting database to identify trends in hiring demand in the industry. We examined the impact of the COVID-19 pandemic and the subsequent recovery of the sector.

Note: These data represent the number of job postings, which are not necessarily the number of vacant positions.

Year |

Number of Job Postings (Approx.) |

|---|---|

Jan-19 |

6800 |

Mar-19 |

7000 |

May-19 |

8200 |

Jul-19 |

7800 |

Sep-19 |

8000 |

Nov-19 |

9800 |

Jan-20 |

6900 |

Mar-20 |

6000 |

May-20 |

3400 |

Jul-20 |

6000 |

Sep-20 |

6500 |

Nov-20 |

5800 |

Jan-21 |

4300 |

Mar-21 |

6800 |

May-21 |

6000 |

Jul-21 |

12000 |

Sep-21 |

13000 |

Nov-21 |

13800 |

Jan-22 |

11000 |

Mar-22 |

14000 |

May-22 |

17000 |

Jul-22 |

17800 |

Sep-22 |

17000 |

As reflected in the Statistics Canada data, there was a sharp decrease in the number of job postings in the food and accommodation sector around April 2020. Hiring demand for the sector rose after March 2022 once COVID-19 restrictions began to lift (external link) following the Omicron wave. The sharp increase in job postings aligns with the aforementioned 40% increase in job vacancies in March 2022.

Newcomers in the Accommodation and Food Industry

New immigrants to Canada are highly beneficial to the food and accommodation industry as they can help to fill some of the worker shortages. Newcomers have long been a vital source of talen (external link) t (external link) for the industry; prior to the COVID-19 pandemic, one in four workers in the sector were immigrants. The sector employed 11% of all immigrants who came to Canada between 2011 and 2016, making it the top employer of immigrants. Further, over one-half of business owners with paid staff in this sector are immigrants.

To address the severe worker shortages in the restaurant industry, Nova Scotia added new pathways for immigrants to secure food service work by adding new occupations to its Occu (external link) pations in Demand stream (external link) . However, the border closures of the past two years have meant that many potential immigrants have not been able t (external link) o enter Canada (external link) and the country is playing catch-up to make up for the gaps.

As newcomers are vital to aiding the recovery of the accommodation and food sector, it is important to identify which occupations in particular are likely in need of more newcomer talent. The table below shows the occupations with the highest proportion of immigrant workers in 2016 in the tourism workforce. As this post focuses on occupations within the accommodation and food service sector, our subsequent discussion of skills will focus on five occupations: chefs, restaurant and food service managers, light duty cleaners, bakers and cooks.

| Occupation | Immigrants (%) |

|---|---|

| Taxi and limousine drivers and chauffeurs | 63 |

Chefs |

48 |

Restaraunt and food service managers |

37 |

Light duty cleaners |

36 |

Casino workers |

36 |

Airline ticket and service agents |

35 |

Travel counsellors |

34 |

Bakers |

34 |

Cooks |

29 |

Accounting and related clerks |

29 |

Source: Statistics Canada, 2016 Census, customized tabulations from the MDB Insight - The Post-COVID Future of the Tourism Workforce report published in 2021 by Tourism HR Canada (external link) .

Skills Needed in Occupations in the Accommodation and Food Industry

One of the keys to overcoming the worker shortage in the accommodation and food industry is skills development, particularly the development of social-emotional skills. According to the World Economic Forum 2021 panel, workers in the tourism and hospitality sector are less likely to get training that will help them improve their skills (external link) . A focus on social-emotional skills, such as active listening and problem-solving, can help workers navigate the challenges posed by the hospitality industry’s still-evolving recovery and help them adapt to technological changes (external link) .

As skills are the key to filling worker shortages, we examined which skills are most in demand across occupations in the industry overrepresented by newcomer workers. Using the Vicinity Jobs database, we examined the top 10 skills most often mentioned in job postings for the five occupations in this sector that employed the most newcomers. We restricted our analysis to job postings between Aug. 1, 2022 and Oct. 31, 2022, so that the skills mentioned would be the ones most relevant to the current environment. The descriptions of each occupation were pulled from Statistics Canada’s National Occupational Classification (NOC), 2011.

Chefs (NOC: 6321)

Statistics Canada defines this (external link) group as “various types of chefs who plan and direct food preparation and cooking activities and who prepare and cook meals and specialty foods. They are employed in restaurants, hotels, hospitals and other health care institutions, central food commissaries, clubs and similar establishments, and on ships.”

Skill |

Number of job postings mentioning the skill |

% of job postings citing the skill* |

|---|---|---|

Cooking / meal preparation |

2764 |

94.1 |

Teamwork |

1209 |

41.2 |

Communication |

987 |

33.6 |

Fast-paced setting |

981 |

33.4 |

Leadership |

785 |

26.7 |

Flexibility |

757 |

25.8 |

Supervisory |

723 |

24.6 |

Organizational |

654 |

22.3 |

Food menu planning |

647 |

22 |

Attention to detail |

645 |

22 |

* For all calculations of the percentages, 20.3% (n = 1,239) of the job postings were not included in the analysis due to the lack of reliable and relevant information.

Not surprisingly, cooking and meal preparation skills were mentioned in almost all job postings. The next two most frequently mentioned skills were teamwork (41.2%) and communication (33.6%).

Restaurant and Food Service Managers (NOC: 0631)

Statistics Canada defines this (external link) group as restaurant and food service managers who “plan, organize, direct, control and evaluate the operations of restaurants, bars, cafeterias and other food and beverage services. They are employed in food and beverage service establishments, or they may be self-employed.”

Skill |

Number of job postings mentioning the skill |

% of job postings citing the skill |

|---|---|---|

Customer service |

2453 |

50.3 |

Organizational |

2358 |

48.4 |

Supervisory |

2256 |

46.3 |

Teamwork |

2179 |

44.7 |

Occupational health and safety |

2079 |

42.7 |

Fast-paced setting |

1875 |

38.5 |

Work scheduling |

1823 |

37.4 |

Communication |

1745 |

35.8 |

Flexibility |

1725 |

35.4 |

Leadership |

1658 |

34 |

The top three most commonly mentioned skills were customer service (50.3%), organizational (48.4%) and supervisory (46.3%). With the exception of occupational health and safety skills, all of the in-demand skills were social-emotional rather than technical or trade skills.

Light Duty Cleaners (NOC: 6371)

Statistics Canada defines this (external link) group as light-duty cleaners who “clean the lobbies, hallways, offices and rooms of hotels, motels, resorts, hospitals, schools, office and other buildings, and private residences. They are employed by hotels, motels, resorts, recreational facilities, hospitals and other institutions, building management companies, cleaning service companies and private individuals.”

Skill |

Number of job postings mentioning the skill |

% of job postings citing the skill |

|---|---|---|

Cleaning |

7312 |

79 |

Teamwork |

3096 |

33.5 |

Attention to detail |

2308 |

24.9 |

Flexibility |

2235 |

24.2 |

Customer service |

1892 |

20.4 |

Communication |

1871 |

20.2 |

Kitchen cleaning |

1672 |

18.1 |

Handling heavy loads |

1405 |

15.2 |

English language |

1384 |

15 |

French language |

1371 |

14.8 |

Nearly 80% of the job postings mentioned cleaning as a skill in the job posting, followed by teamwork (33.5%) and attention to detail (24.9%). Interestingly, this was the only occupation out of the five examined where language skills in English and French were in the top 10.

Bakers (NOC: 6332)

Statistics Canada defines this group as bakers who “prepare bread, rolls, muffins, pies, pastries, cakes and cookies in retail and wholesale bakeries and dining establishments. They are employed in bakeries, supermarkets, catering companies, hotels, restaurants, hospitals, and other institutions, or they may be self-employed. Bakers who are supervisors are included in this unit group.”

Skill |

Number of job postings mentioning the skill |

% of job postings citing the skill |

|---|---|---|

Teamwork |

1048 |

45.9 |

Fast-paced setting |

988 |

43.3 |

Customer service |

892 |

39.1 |

Flexibility |

817 |

35.8 |

Handling heavy loads |

642 |

28.1 |

Communication |

629 |

27.6 |

Attention to detail |

559 |

24.5 |

Organizational |

491 |

21.5 |

Production scheduling |

401 |

17.6 |

Inventory management |

376 |

16.5 |

The top two skills, teamwork and ability to work in a fast-paced setting, were mentioned in about 45% of job postings, closely followed by customer service (39.1%). In some job postings for bakers, they were also expected to handle production scheduling and inventory management, which are not the skills typically expected from bakers. This may suggest that businesses are looking for more experienced bakers who are able to handle these tasks.

Cooks (NOC: 6322)

Statistics Canada defines this group as cooks who “prepare and cook a wide variety of foods. They are employed in restaurants, hotels, hospitals and other health care institutions, central food commissaries, educational institutions and other establishments. Cooks are also employed aboard ships and at construction and logging campsites. Apprentice cooks are included in this unit group.”

Skill |

Number of job postings mentioning the skill |

% of job postings citing the skill |

|---|---|---|

Cooking / meal preparation |

19173 |

93.7 |

Teamwork |

8500 |

41.5 |

Fast-paced setting |

7013 |

34.3 |

Kitchen cleaning |

6825 |

33.3 |

Inventory management |

5579 |

27.3 |

Organizational skills |

4926 |

24.1 |

Records management |

4897 |

23.9 |

Kitchen management |

4857 |

23.7 |

Cleaning |

4792 |

23.4 |

Communication |

4319 |

21.1 |

Comparing the skills of chefs and cooks, the top two were identical, with almost all of the job postings for cooks mentioning cooking and meal preparation. They also mentioned teamwork. Interestingly, communication skills were mentioned in about 20% of job postings for cooks compared to about 35% for chefs. That communication skills for cooks ranked lower than for chefs suggests that other skills may take priority among cooks. Typically, chefs have more supervisory responsibilities that require communication with other kitchen staff and coordination with other departments.

Looking Forward

The labour market data suggest that while the accommodation and food industry is recovering, it will continue to face labour shortages as unemployment rates stay low and people are drawn to other industries that allow employees to work from home. While low wages have often been cited as a reason workers leave the industry, over one-half of industry workers (external link) have said that no amount of money would get them to return due to the high-stress nature of the job and the poor treatment of staff. The worker shortage also puts additional pressure on existing staff (external link) to put out more fires, which leads them to quit and makes the sector less appealing to new workers..

One strategy to fill the shortage is through immigration—by opening more pathways for newcomers to enter Canada and participate in the economy. To do so, however, we need to understand the barriers for newcomers who want to enter the food and accommodation sector, what kind of skills training they need and what businesses can do to attract them.

The Future Skills Centre has recently funded a project led by Skills for Change (external link) called “Identifying solutions towards aspired career pathways and quality of work in the hospitality and tourism sector – newcomers’ perspectives” (external link) that aims to address these questions. Through interviews with newcomers and employers , the research aims to understand labour market trends, challenges faced by newcomer workers in the accommodation and food sector, and challenges faced by employers in ensuring quality work.

Table data sourced from the Vicinity Jobs hiring demand analytics suite (external link) .

Author

Christopher Zou, Senior Research Associate, Diversity Institute

Labour Market Insights

A research series by the Diversity Institute

Reports in the Labour Market Insights from the Diversity Institute series cover a variety of topics relevant to the study of labour markets and are based on analyses of collated data from online job postings across Canada, as well as other traditional and innovative data sources. This project is funded by the Government of Canada’s Future Skills Centre (external link) .