Financing Your Education

Paying for your education is a big but valuable investment. It’s important to budget for all costs like tuition, books, supplies, transportation, food, and living expenses.

There are many ways to financially prepare for your education:

- Ontario Student Assistance Program (external link, opens in new window) (OSAP)

- TMU-specific OSAP info is available on our website.

- Awards, scholarships and bursaries

- Check out AwardSpring (external link, opens in new window) , a place for students to apply for TMU's 1,400 scholarships and bursaries.

- Check your eligibility for Federal Government Scholarships (external link, opens in new window) .

- There are also scholarships from banks available such as TD Bank Scholarships (external link, opens in new window) , or RBC Scholarships (external link, opens in new window) .

- Your family employers, religious groups, community and sports involvements may also offer scholarships.

- Out-of-province student government financial aid (for Canadian non-Ontario residents).

- U.S. Loans for American students

- Talk to your bank for student loans and line of credit options

- Financial assistance from Ontario Works (external link, opens in new window) .

- Check out Scholarships Canada (external link, opens in new window) , Yconic (external link, opens in new window) , Scholar Tree (external link, opens in new window) , and Student Awards (external link, opens in new window)

Budgeting Tips: Student Discounts to Save Money

There are many ways to help save money when paying for school. Below are our top tips for students.

It can be really easy to spend more than you realize (especially when you go to school across from the Eaton Centre)! For example, if you have class on campus five days a week and buy yourself a cup of coffee every day for $3.50, that works out to approximately $210 a semester! It is okay to treat yourself, just know what is in your budget and stick to it.

To keep within your budget, you can make small changes to your routine to help save costs:

- Invest in a travel mug to bring your own coffee to campus. If you’re in need of a refill, many coffee shops will give you a discount for using your own mug.

- Pack a lunch instead of buying lunch. You can make this a game for yourself: for every nine times you pack a lunch, you can treat yourself to purchase lunch next time. When you do buy lunch, use your OneCard - many restaurants around campus will offer discounts to students!

- Resist temptation. If you spend your break between classes walking around the Eaton Centre, it will be much easier to spend money. Find new areas to walk around campus, or get your exercise at the Recreation and Athletic Centre or Mattamy Athletic Centre, which is free for full-time students with your OneCard!

- Plan ahead and know what resources are available to you. Take a few minutes before the start of each week to figure out how much you will be spending, and if you can reduce the amount you spend by using the resources found on this page!

The Government of Canada also offers a helpful Budget Planner (external link, opens in new window) . Try to create a budget well ahead of the school year and monitor your budget routinely to make sure you are on track. There are also many phone apps you can download to monitor your budget. Browse your phone’s app store for more information.

The Canada Learning Bond is money the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full-time or part-time studies after high school if they pursue an apprenticeship, CEGEP, trade school, college, or university. Personal contributions to a RESP are not required to receive the Canada Learning Bond. For more information, visit Canada Learning Bond.

TTC:

If you use the Toronto Transit Commission (TTC), you can apply for a Post-Secondary Student Monthly Metropass (external link, opens in new window) .

GO transit:

If you use GO Transit, the GO Transit Student ID Card gives discounts to college and university students who use their PRESTO card.

To be eligible, undergraduates need to be in a full course load in fall and winter. While graduate students need to be in a full-time program and a full course load. Apply for the ID card online. For more info, visit GO Transit Post-Secondary Student Discount (external link, opens in new window) .

After following the voucher instructions on the PRESTO website, check that your PRESTO card has the discount.

To confirm your card's discount status is active:

- Log in to the PRESTO website

- Proceed to Account

- Manage My Card

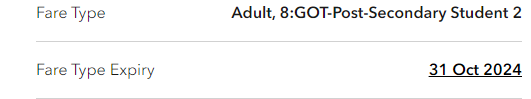

- Check the "Fare Type" on the right side. The image shows an example of a successful discount application.

Remember to reapply every year! The Post-Secondary fare type expires annually from your PRESTO card. Check the expiration date on your PRESTO account (as shown in the image). Apply early to avoid losing the discount.

Digital textbooks are often cheaper than physical textbooks. If you prefer physical books, there are also used bookstores near campus, or various social media platforms (such as Facebook) where you can buy and trade used textbooks with other students.

The TMU Library has a program called the Textbook Collection (opens in new window) that allows students to take out their textbooks for a short-term loan.

Your student ID, your OneCard, will allow you to save money around campus. You can enjoy free admission to TMU Bold home games and free access to the Recreation and Athletic Centre (RAC) and Mattamy Athletic Centre (MAC). Beyond campus, many restaurants and shops near TMU offer discounts to students who show their student ID.

The Student Price Card (SPC) (external link, opens in new window) gives you access to discounts at many restaurants and stores around Toronto and the Greater Toronto Area (especially near campus)! There is a small annual cost, but the savings will make up for it. Depending on who you bank with, you may even get a free SPC! You can confirm directly with your bank.

The International Student Identification Card (ISIC) (external link, opens in new window) is your “passport” to access student discounts in Canada and worldwide.

Services such as Odd Bunch (external link, opens in new window) , Flashfood (external link, opens in new window) and FoodShare (external link, opens in new window) , provide discounted groceries with convenient ordering options.

The TMSU also provides support through the Good Food Centre (external link, opens in new window) . Any TMU student facing any level of food insecurity (the inability to obtain food that meets your dietary needs) can use these services.

TMU has an award-winning campus job program called Career Boost. Career Boost provides full-time undergraduate, graduate and law students with the opportunity to work for the University. Part-time in the fall and winter semesters, and full-time in the spring and summer semesters. The benefit of working on campus is that employers are very flexible, which means you can spend that four-hour break between classes earning some money!

Looking for off-campus work? Check out Jobs Off Campus.

Youth Job Connection (external link, opens in new window) can also support you through mentoring services, education, training, and much more.

As a TMU student, you are eligible for student education discounts through Dell or Apple. You can access educational pricing by logging on to your my.torontomu.ca (opens in new window) account, and navigate to the bottom left corner of the homepage.

Many tech companies also offer student deals/discounts on electronics throughout the school year, especially right before the new academic year begins. Make sure to check online before starting your semester.

Did you know that you can negotiate your phone bill, internet/TV bill, or even your car insurance? You do not need to wait for your contract to renew to negotiate your rate. Offers become available throughout the year, and it’s important to negotiate your rate. If you do wait for your contract to end, be sure to start negotiating at least two months in advance.

Tip: Try negotiating things like your phone bill, internet bill, or other services around holidays such as Black Friday or Christmas. Service providers often have special deals, and you can end up saving a significant amount of money!

TMU offers a free pop-up store that is dedicated to helping students reduce their environmental impact and save money. You may find electronics, office supplies, home decor, kitchen supplies, books, and more, all for free!

Tax filing is very important for students to complete each year. Regardless of your income amount, there are many benefits associated with filing taxes. For more information on these benefits, refer to the Canada Revenue Agency (opens in new window) (CRA).

International students seeking support with their taxes can refer to TMU's international Student Support Tax Services.

Your local public library may also offer free tax clinics, as well as other personal financial advice. The closest public library to TMU is the Toronto Public Library (external link, opens in new window) .

If you are from a low-income household, you may be eligible for additional financial assistance through one or more publicly-funded programs such as the Ontario Electricity Support Program (OESP), the Low-Income Energy Assistance Program (LEAP), or the Energy Affordability Program (EAP). For more information on support for utility costs, please visit the Additional Financial Supports page.