Labour Market Insights on the Clean Technology (Cleantech) Sector

Introduction

The Government of Canada has recognized the urgency of the climate crisis by passing the Canadian Net-Zero Emissions Accountability Act on June 29, 2021, and making significant financial commitments to net-zero, including investments in clean technology (cleantech) innovation, such as the $15-billion Canada Growth Fund to spur private capital investments into decarbonization and cleantech projects.[1] Canada has also committed to a “just transition,” the aim of which is “to ensure that the transition to a net-zero economy is done in a way that creates new opportunities for Canadian workers and their communities—providing sustainable jobs for Canadians in every region.”[2]

With these new investments and growth opportunities, workers may require new skills and competencies to participate meaningfully in the cleantech sector. Recent research by the Smart Prosperity Institute with the Diversity Institute and Future Skills Centre explores three scenarios for net-zero emissions and investigates the impacts on labour demand and skills in different sectors in 2050. While the pace of change differs, the direction is clear: New jobs will emerge not just in the cleantech sector, but also across other sectors as they introduce new processes to their value chains.[3] The availability of cleantech, while important, is not the only issue as all sectors will be affected. Attention to the organizational transformation and adoption of cleantech and associated jobs and skills, is critically important.

Similarly, ECO Canada’s (2020) Cleantech Defined: A Scoping Study of the Sector and Its Workforce report (external link) ,[4] which was commissioned by the Government of Canada’s Sector Initiatives Program to define the cleantech sector, shows the sector’s wide relevance.[5] The report defines cleantech as “technology that uses less material or energy, generates less waste, and causes less negative environmental impacts than the industry standard.” This means that the cleantech economy is a “broad and inclusive sector [that] practically spans all industries in Canada.”[6] As noted by the Diversity Institute in the Globe and Mail’s Excellence in Research and Innovation report (external link) , with its wide-ranging impacts, the cleantech sector resembles the information communications and technology (ICT) sector and enables innovation.[7] As digitization has taken root, there are now more ICT jobs outside of the ICT sector than within it, many of them hybrid roles focused on implementation, organizational transformation and adoption. We can expect similar patterns to emerge with cleantech as we move to net zero.[8]

Given the evolving nature of the cleantech sector, assessing the labour market characteristics and triangulating a variety of sources is necessary to understand the impact on jobs. Some previous efforts have examined the in-demand skills of the sector through a survey and interviews with cleantech companies.[9] This post aims to contribute to this conversation by drawing upon the Vicinity Jobs database to analyze job posting data and in-demand skills by industry or sector.[10]

ECO Canada identifies five subsectors in the cleantech sector and lists a series of North American Industry Classification System (NAICS) codes related to each one (see Appendix B).[11] The five subsectors are 1. Alternative Energies 2. Energy Efficiency and Green Building Development 3. Sustainable Transportation 4. Waste Reduction and Lifecycle Management and 5. Support Services, Green Knowledge and Conservation. ECO Canada uses these subsectors to identify organizations that could comment on and validate their definition of the cleantech workforce. Although it is not intended to be a definitive list of cleantech sectors, we think it is an excellent starting point to understand the labour market characteristics—specifically job posting trends and skills sought—of the cleantech sector.[12] Accordingly, we use these NAICS codes to identify the relevant job postings from the Vicinity Jobs database.

Job Postings Analysis

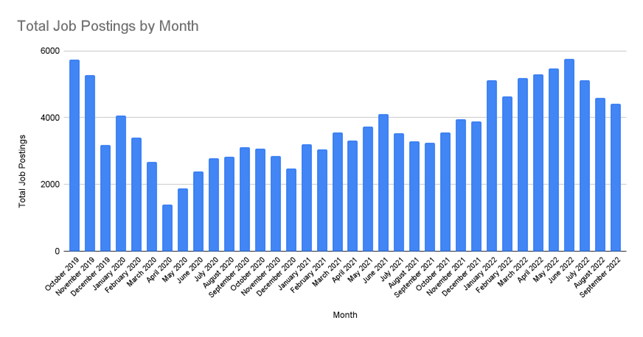

We looked at job postings from October 1, 2019, to September 30, 2022, to analyze labour market postings over a three-year period (Figure 1).[13] The period covers labour market trends before the COVID-19 pandemic lockdowns for a better overview of the cleantech sector.

Figure 1. Number of Online Job Postings by Month, October 1, 2019, to September 30, 2022

Note: Job postings in the Vicinity Jobs database undergo periodic database and methodology changes, leading to minor data changes in the range of 1% to 5%. A rare large update led to a 5% to 10% increase in job postings in April 2022. We determined that these minor changes do not overdetermine the job posting trends we discuss below.

Month |

Total Job Postings |

|---|---|

| October 2019 | 5746 |

| November 2019 | 5280 |

| December 2019 | 3174 |

| January 2020 | 4055 |

| February 2020 | 3407 |

| March 2020 | 2668 |

| April 2020 | 1406 |

| May 2020 | 1878 |

| June 2020 | 2396 |

| July 2020 | 2792 |

| August 2020 | 2829 |

| September 2020 | 3108 |

| October 2020 | 3065 |

| November 2020 | 2860 |

| December 2020 | 2473 |

| January 2021 | 3204 |

| February 2021 | 3059 |

| March 2021 | 3551 |

| April 2021 | 3327 |

| May 2021 | 3729 |

| June 2021 | 4109 |

| July 2021 | 3537 |

| August 2021 | 3289 |

| September 2021 | 3248 |

| October 2021 | 3561 |

| November 2021 | 3957 |

| December 2021 | 3878 |

| January 2022 | 5123 |

| February 2022 | 4629 |

| March 2022 | 5183 |

| April 2022 | 5308 |

| May 2022 | 5473 |

| June 2022 | 5755 |

| July 2022 | 5119 |

| August 2022 | 4599 |

| September 2022 | 4407 |

The cleantech sector witnessed a decline in job postings corresponding with the timeline of the COVID-19 pandemic as provinces started to declare a state of emergency in March 2020.[14] The dip in job postings in April 2020 mirrors the low job posting numbers in the overall economy.[15] Job postings in the sector have gradually recovered over time.

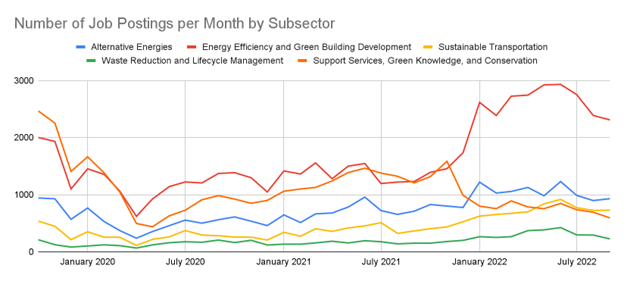

Figure 2. Job Postings by Month by Subsector, October 1, 2019, to September 30, 2022

Month/Subsector |

Alternative Energies |

Energy Efficiency and Green Building Development |

Sustainable Transportation |

Waste Reduction and Lifecycle Management |

Support Services, Green Knowledge, and Conservation |

|---|---|---|---|---|---|

| October 2019 | 943 | 2002 | 537 | 211 | 2466 |

| November 2019 | 928 | 1933 | 447 | 124 | 2254 |

| December 2019 | 569 | 1100 | 213 | 83 | 1408 |

| January 2020 | 767 | 1453 | 83 | 102 | 1664 |

| February 2020 | 528 | 1355 | 102 | 122 | 1381 |

| March 2020 | 372 | 1062 | 256 | 108 | 1046 |

| April 2020 | 238 | 621 | 111 | 66 | 496 |

| May 2020 | 355 | 926 | 218 | 121 | 438 |

| June 2020 | 457 | 1141 | 261 | 159 | 630 |

| July 2020 | 555 | 1223 | 372 | 176 | 727 |

| August 2020 | 501 | 1206 | 294 | 167 | 911 |

| September 2020 | 562 | 1372 | 281 | 205 | 984 |

| October 2020 | 611 | 1386 | 258 | 162 | 923 |

| November 2020 | 536 | 1297 | 256 | 201 | 850 |

| December 2020 | 459 | 1048 | 206 | 119 | 900 |

| January 2021 | 646 | 1416 | 342 | 134 | 1061 |

| February 2021 | 513 | 1362 | 272 | 133 | 1100 |

| March 2021 | 664 | 1557 | 404 | 156 | 1127 |

| April 2021 | 680 | 1280 | 358 | 185 | 1241 |

| May 2021 | 784 | 1500 | 417 | 155 | 1388 |

| June 2021 | 958 | 1546 | 454 | 194 | 1464 |

| July 2021 | 722 | 1196 | 510 | 176 | 1378 |

| August 2021 | 655 | 1221 | 323 | 139 | 1322 |

| September 2021 | 711 | 1231 | 365 | 151 | 1207 |

| October 2021 | 828 | 1391 | 405 | 151 | 1316 |

| November 2021 | 801 | 1456 | 436 | 180 | 1585 |

| December 2021 | 776 | 1734 | 526 | 200 | 990 |

| January 2022 | 1220 | 2617 | 625 | 265 | 799 |

| February 2022 | 1029 | 2387 | 654 | 252 | 756 |

| March 2022 | 1057 | 2725 | 673 | 265 | 891 |

| April 2022 | 1127 | 2744 | 700 | 371 | 786 |

| May 2022 | 981 | 2923 | 839 | 384 | 755 |

| June 2022 | 1230 | 2932 | 917 | 424 | 847 |

| July 2022 | 988 | 2753 | 773 | 296 | 737 |

| August 2022 | 897 | 2386 | 725 | 293 | 693 |

| September 2022 | 931 | 2310 | 728 | 226 | 593 |

The job postings by subsector tell another story (Figure 2). While job postings in all subsectors declined in April 2020, certain subsectors experienced stronger recovery.

The Energy Efficiency and Green Building Development subsector consistently had some of the highest job posting numbers and experienced a notable jump in online job postings from December 2021 onward. Conversely, the Waste Reduction and Lifecycle Management subsector consistently had the fewest job postings, although it has experienced an uptick in the number of job postings in the last year. The Support Services, Green Knowledge and Conservation subsector, while consisting only of two NAICS codes (see footnote 7), has been one of the largest contributors to job postings in the sector, but has declined since November 2021.

Skills Demanded in Job Postings

We also examined skills demanded in job postings during a two-and-a-half year period from April 1, 2020, to September 30, 2022, to see which skills are most in-demand in the sector.[16]

Table 1. Top 10 Skills, April 1, 2020, to September 30, 2022

Rank |

Skill |

Skills Group |

Number of Job Postings |

Percentage of Job Postings |

|---|---|---|---|---|

1 |

Teamwork |

Social-Emotional Skills |

48212 | 47.6 |

2 |

Communication Skills |

Social-Emotional Skills | 46314 | 45.7 |

3 |

Customer Service |

Occupational Skills[17] | 29556 | 29.2 |

4 |

Leadership |

Social-Eotional Skills | 27517 | 27.2 |

5 |

Attention to Detail |

Social-Emotional Skills | 21170 | 20.9 |

6 |

Organizational Skills |

Social-Emotional Skills | 19550 | 19.3 |

7 |

Microsoft Office |

Technologies[18] | 19018 | 18.8 |

8 |

Interpersonal Skills |

Social-Emotional Skills | 18786 | 18.5 |

9 |

Time Management |

Social-Emotional Skills |

18089 | 17.8 |

10 |

Microsoft Excel |

Technologies | 17571 | 17.3 |

Note: The values under the column “percentage of job postings” were calculated using job postings with a NAICS code assigned (see footnote 13).

Most of the top skills in job postings are social-emotional skills,[19] such as teamwork, communication, leadership, attention to detail and organizational skills. Microsoft Office and Excel were the only technology skills that made it into the top 10. Even when we look at the top skills within each subsector, social-emotional skills remain the most commonly sought.

Table 2. Top 10 Skills, Technologies Skills Group, April 1, 2020, to September 30, 2022

Rank |

Skills |

Number of Job Postings |

|---|---|---|

1 |

Microsoft Office |

19018 |

2 |

Microsoft Excel | 17571 |

3 |

Microsoft Word |

13304 |

4 |

Microsoft Powerpoint |

6946 |

5 |

Microsoft Outlook |

4639 |

6 |

Microsoft Suite |

4552 |

7 |

Enterprise Resource Planning (ERP) Software |

3610 |

8 |

SAP |

3378 |

9 |

Customer Relations Management (CRM) software |

2183 |

10 |

Oracle |

1830 |

Additionally, when technology skills are required, the data indicate that organizations are most often looking for basic digital literacy skills––Microsoft Office and Excel––rather than “deep technical skills” like Javascript, C# and C++. The number of job postings that requested the latter skills are 725, 534 and 344, respectively.

Conclusion

As the conversations on net-zero and sustainability evolve, it becomes increasingly evident that the economy will change and the labour market with it. Cleantech is one projected avenue of growth in the coming clean economy. Given the large Government of Canada investment and private sector interest, we need good labour market data to inform policy makers, the skills training ecosystem, workers and employers.

This analysis is a preliminary investigation; as an emerging field, there are many opportunities for additional research and data collection. For instance, as the cleantech sector grows, the need for reliable and granular labour market information will be critically important, especially to support meaningful conversations about equity, diversity and inclusion in the sector.

In our investigation, we found that social-emotional skills are some of the most demanded skills in job postings. This demonstrates the importance of non-specialized and non-technical skills like communication, teamwork and customer service, even in an ostensibly technical field. This reaffirms the importance and transferability of foundational skills and competencies, many of which are listed in ESDC’s the Skills for Success framework.[20]

We do not mean to suggest that technology skills are not important for the sector. Rather, we want to point out that discussions on skilling and reskilling for the cleantech sector cannot be limited to these specialized skills. The findings mirror the Diversity Institute’s research on the digital skills gap in the ICT sector.[21] Cleantech jobs are not synonymous with computer science, engineering and other high-tech professions. Instead of skills like Javascript and C#, digital literacy skills, such as use of Microsoft Office, are more frequently sought after in job postings. Additionally, like the ICT sector, there may also be a wide range of unclassified hybrid roles–these are the workers with technical skills that mediate between technical experts and other functions of the organization, such as customer management.[22]

As ECO Canada suggests, “the technologies, companies and workers considered to be part of cleantech today, may not necessarily be part of the cleantech economy in the future. Periodic snapshots of this sector are crucial to help shed light on job opportunities and their trajectory, as well as workforce challenges and opportunities.”[23] Similar analyses using the Vicinity Jobs database will be useful to take snapshots of the cleantech sector and capture the shifting nature of the sector in the future.

[1] https://budget.gc.ca/2022/report-rapport/chap3-en.html

[2] https://www.rncanengagenrcan.ca/en/collections/just-transition

[3] Atiq, M., Coutinho, A., Islam, A., & McNally, J. (2022). Jobs and Skills in the Transition to a Net-Zero Economy: A Foresight Exercise. Smart Prosperity Institute. Diversity Institute. Future Skills Centre. https://institute.smartprosperity.ca/sites/default/files/Jobs_and_Skills_in_the_Transition_to_a_Net-Zero_Economy.pdf

[4] ECO Canada. (2020). Cleantech Defined: A Scoping Study of the Sector and its Workforce.

[5] The report was commissioned to address the wide variety of definitions used across North America, given the relative infancy of the cleantech sector, which has led to discrepancies in sectoral definition.

[6] ECO Canada. (2020).Cleantech Defined: A Scoping Study of the Sector and its Workforce, page 7. See Appendix A for the definitions of cleantech, the cleantech economy and the cleantech workforce offered in the report.

[7] Cukier, W. (2022, Nov 18). An inclusive, net-zero future. The Globe and Mail. https://www.theglobeandmail.com/life/adv/article-an-inclusive-net-zero-future/ (external link)

[8] Cukier, W. (2022, Oct 19). Panel 4: Ensuring women, Indigenous peoples, youth and other underrepresented groups are supported and equipped to succeed in current and future careers, including in fast-growing areas related to the transition to a lower carbon economy [Panel]. Global Affairs Canada Workforce Development Event & CUSMA Competitiveness Committee Meeting, Manitoba.

[9] Foresight Canada. (2022). Building Skills for a Clean Economy: Guiding Workforce Transitions as Canada Shifts to Net Zero Emissions. https://foresightcac.com/wp-content/uploads/2022/05/Future-Skills-Report_March-2022.pdf

[10] Vicinity Jobs. (n.d.). Hiring demand analytics suite. https://www.vicinityjobs.net/hiring-demand-analytics-suite

[11] ECO Canada. (2020). Cleantech Defined: A Scoping Study of the Sector and its Workforce.

[12] The fifth sub-sector (Support Services, Green Knowledge and Conservation) includes numerous NAICS codes that are not directly related to the cleantech sector, such as NAICS code 6113 Universities. To avoid inflating the job posting numbers and avoid non-representative skills data, we only retained NAICS codes 54162 Environmental consulting services and 54169 Other scientific and technical consulting services (energy consulting) in the latter sub-sector in the Vicinity Jobs database analysis.

[13] The number of job postings in these sectors is likely an undercount due to some limitations with the Vicinity Jobs database. For example, more than 1.6 million job postings (60%) from 2021 could not be matched with a NAICS code. This analysis only uses the job postings that could be matched with a NAICS code.

[14] A rough overview of the COVID-19 timelines are found at https://www.ctvnews.ca/health/coronavirus/grim-anniversary-a-timeline-of-one-year-of-covid-19-1.5280617

[15] Kim, Y., Jae, K., & Zou, C. (2022). Job Posting: Trends in Canada 2021 Update. https://www.torontomu.ca/diversity/reports/Job_Posting_Trends_in_Canada.pdf

[16] We examined a different set of time periods for job posting numbers and skills demanded in job postings because the Vicinity Jobs database archived its data on March 31, 2020, and the list of skills demanded in the pre-archived database and the current database do not match 100%.

[17] The occupational skills group consists of skills subgroups like administrative skills, analysis and research skills, customer service skills, education and training skills, and health and safety skills.

[18] The technologies skills group include subgroups like accounting software, administration software, analytical or scientific software, and business intelligence and data analysis software.

[19] The social-emotional skills group include skills sub-groups like cognitive skills, interpersonal skills, language skills, resource management skills and personal qualities.

[20] See the ESDC Skills for Success framework https://www.canada.ca/en/services/jobs/training/initiatives/skills-success.html

[21] Shortt, D., Robson, B., & Sabat, M. (2020). Bridging the Digital Skills Gap: Alternative Pathways. https://www.torontomu.ca/diversity/reports/Digital-Skills-Alternative-Pathways.pdf

[22] Shortt, D., Robson, B., & Sabat, M. (2020). Bridging the Digital Skills Gap: Alternative Pathways. (PDF file) https://www.torontomu.ca/diversity/reports/Digital-Skills-Alternative-Pathways.pdf

[23] ECO Canada. (2020). Cleantech Defined: A Scoping Study of the Sector and its Workforce, page 18.

Authors

Kevin (Joong-Woo) Jae, Yuna Kim

Labour Market Insights

A research series by the Diversity Institute

Reports in the Labour Market Insights from the Diversity Institute series cover a variety of topics relevant to the study of labour markets and are based on analyses of collated data from online job postings across Canada, as well as other traditional and innovative data sources. This project is funded by the Government of Canada’s Future Skills Centre (external link) .