Shift in GTA’s Real Estate Demand to the 905 Area from Toronto Started Before COVID-19

By: Frank Clayton and Daniel Bailey

August 14, 2020

(PDF file) Print-friendly version available

Summary

News reports are highlighting an exodus of people from the city of Toronto to the 905 area (Durham, York, Peel and Halton) of the Greater Toronto Area (“GTA”) since the beginning of the COVID-19 pandemic shutdowns of March of 2020. CUR’s recent research, however, shows that Toronto’s resident population has been leaving for the 905 area and beyond since 2016, suggesting that some other fundamental factors are at play. As well, the shift in office space absorptions from the city of Toronto to the 905 area had already begun pre- COVID-19. Growth in industrial space absorptions continues to be found largely in the 905 area, counter to some expectations concerning the growing preferences of online retailers for “last mile” warehousing locations.

Introduction

The media has reported extensively on the movement of Toronto residents to more spacious suburban locations in the 905 area and beyond, as they search for housing that is more affordable, larger, and more conducive to working from home. Evidence supporting this storyline has been the smaller decline and speedier recovery in MLS residential sales in the 905 area (Durham, York, Peel and Halton) than in Toronto, following the COVID-19 lockdowns – a trend CUR first observed in the July 10th edition of our (PDF file) GTA Housing Pulse.

There is also media speculation that downtown office users are starting to look at satellite offices in the suburbs to give 905-based workers the opportunity to return to the office while avoiding long commutes to downtown Toronto. In contrast, some resurgence in the city of Toronto’s industrial market seems possible, as online retailers establish warehousing operations near denser population centres.

This blog looks at how real estate demand has been spread out across the GTA area over time and asks if the 905 area’s recent strength is a short-term phenomenon related to COVID-19, or if there are more fundamental forces at work. The blog finds the 905 area had seen more growth in both residential and office real estate demand than Toronto even prior to COVID-19.

No question of a shift in GTA MLS sales to the 905 area in the first half of 2020

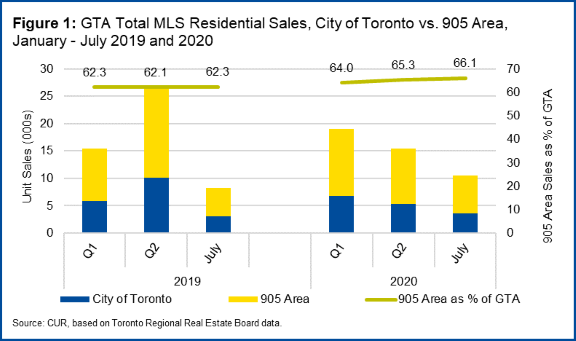

Figure 1 shows MLS residential sales in the GTA in the first seven months of 2019 and 2020 for both the city of Toronto and the 905 area (data from the Toronto Regional Real Estate Board’s monthly release).

There has been a shift in MLS sales away from Toronto in the first two quarters, a trend which continued in July. During July, 66% of GTA MLS sales were of homes in the 905 area, up from about 62% for the same month last year. These sales include all types of units, including condo apartments.

The shift in MLS sales to the 905 area predates COVID-19

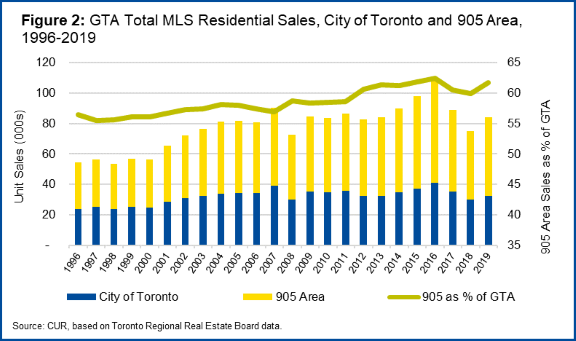

Figure 2 shows annual MLS sales in the GTA for the city of Toronto and the 905 area from 1996 to 2019.

There was a gradual upward shift in sales to the 905 area compared to the city of Toronto from 56% in 1996 to 62% in 2016. This was followed by a dip in the 905 area’s share of sales in 2017 and 2018, which was a period of weaker sales throughout the GTA. The 905’s share of sales recovered in 2019 and, as we have seen, into 2020.

This recent shift in the volume of sales to the 905 area is not unexpected. In a (PDF file) 2017 CUR study of Millennials, we found that most Millennials surveyed expressed a preference for ground-related homes, which are more affordable and abundant in the 905 area than in Toronto.

Shift in GTA new home sales to the 905 area in 2020

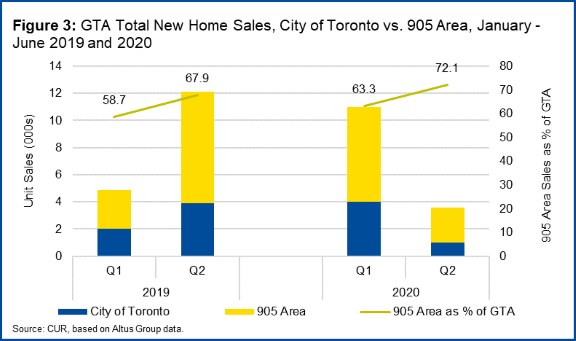

Figure 3 shows new home sales in the GTA for the city of Toronto and the 905 area for the first two quarters of 2019 and 2020 (data from the Altus Group).

There has been a pronounced shift in GTA sales to the 905 area in the first two quarters of 2020 relative to a year ago. In the second quarter, nearly three out of four GTA sales were for homes located in the 905 area.

Again, a shift in new home sales to the 905 area predates COVID-19

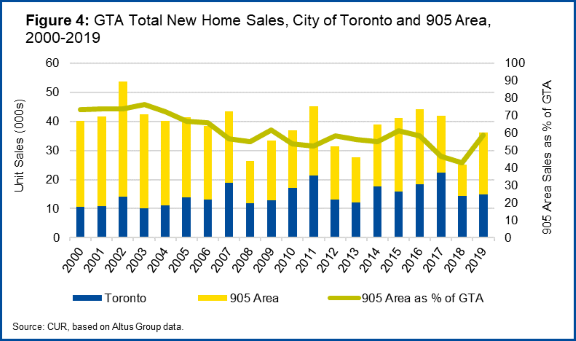

Figure 4 shows annual new home sales in the GTA for the city of Toronto and the 905 area for the period from 2000 to 2019.

In contrast with the long-term MLS sales, there was a pronounced shift in new home sales in the GTA from the 905 area to Toronto between the years 2000 and 2018 – from 74% to 43%. A surge in high-rise apartment demand in central Toronto and along subway lines was a major cause of this trend.

This pattern was reversed in 2019, with the share of new home sales occurring in the 905 area rising to 59%, a trend which continued in 2020. A continued shift away from Toronto is expected since, based on their stated preferences, Millennials will be moving into the market for more affordable ground-related homes.

A shift in GTA population growth to the 905 area in 2018 and 2019 before COVID-19

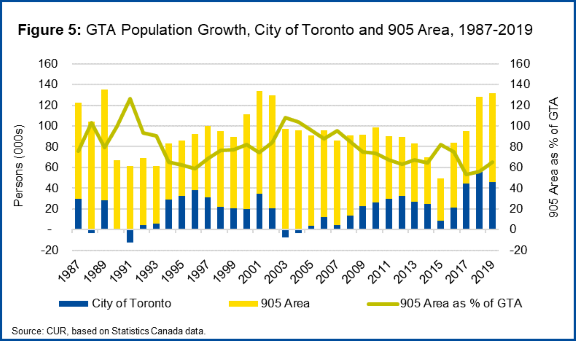

Figure 5 shows annual population growth in the GTA from 1987 to 2019 for the 12 months ending July 1 split between the city of Toronto and the 905 area. (The Statistics Canada post-2016 estimates are subject to revision after the 2021 Census of Canada results become available and predate the COVID-19 shutdowns.)

From the early 2000s to 2017, Toronto’s share of the GTA’s population growth showed an impressive increase from nil to 47%. This corresponds with the upward trend in the city’s share of the GTA’s new home sales. Data from the last two years show a reversal in GTA population growth compared to that in the 905 area – where population growth increased from 53% in 2017 to 65% in 2019.

GTA office space absorptions in first half of 2020 shifted to the 905 area

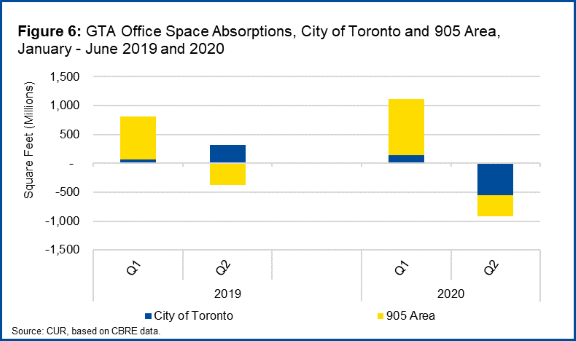

Figure 6 shows office space absorptions in the GTA for the first two quarters of 2019 and 2020 for the city of Toronto and the 905 area (data from CBRE).

Compared to the first two quarters of 2019, Toronto lost market share to its 905 neighbours in 2020, recording smaller positive absorptions or larger negative absorptions in office space. This is not necessarily indicative of trends for the entire year since absorptions are related to new space completions and Toronto did not have any in the first half of this year. The bulk of office space under construction in the GTA overall is in central Toronto.

Office space absorptions were shifting to 905 area before COVID-19

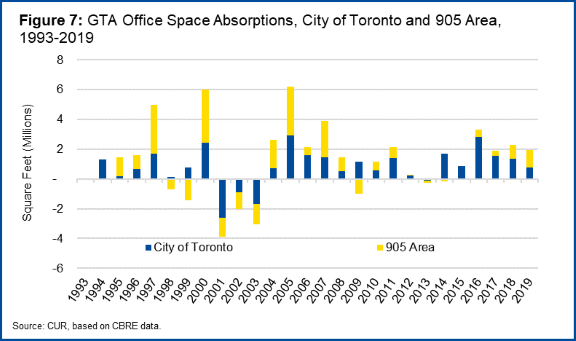

Figure 7 shows annual office space absorptions in the GTA for the city of Toronto and the 905 area from 1993 to 2019.

From 2004 to 2017, Toronto dominated the office space market in terms of absorptions, in contrast with the 1990s when the 905 area reigned supreme. This trend mirrors trends in population growth and new housing sales in the two areas over this period. However, starting in 2018, the 905 area has regained some market share from the city of Toronto.

Industrial space absorptions in the first half of 2020 were all in the 905 area

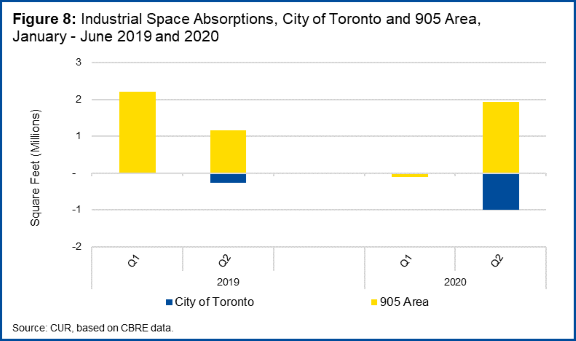

Figure 8 shows industrial building space absorptions in the GTA for the first two quarters of 2019 and 2020 in the city of Toronto and the 905 area (data provided by CBRE).

The data shows Toronto had nil or negative absorptions in industrial space for the two quarters of both 2019 and 2020 and that the decline was greater in the second quarter of 2020 than it was a year ago. As with office space, this is not necessarily indicative of the year as a whole, as Toronto has a significant amount of industrial space under construction (though this is still relatively small compared to that in the 905 area). In future, though, we would expect some increased absorptions in the industrial space market for Toronto, as online retailers look to secure warehousing space closer to population concentrations.

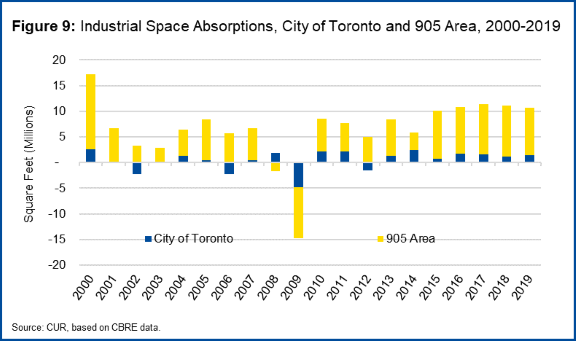

905 area continues to dominate the industrial space market up to 2019

Figure 9 shows annual industrial building space absorptions in the GTA for the city of Toronto and the 905 area for 2000-2019.

From 2000 to 2019 there has been little change in the split in GTA industrial space absorptions between the 905 area and the city of Toronto.

Conclusion

There is little doubt that the forces unleashed by the COVID-19 virus are encouraging some Toronto residents to move or consider moving to the 905 area or beyond. The desire for more affordable ground-related housing with space for home offices are steering this trend. Similarly, some office space users are considering relocating at least part of their operations to the 905 area in the form of satellite offices.

The real estate market indicators we reviewed show that the shift in the GTA resale and new housing sales to the 905 area, as well as in office space absorptions, started before COVID-19. Also, to date, there has not been a shift in industrial space absorptions to the city of Toronto.

_________________________________________________________________________________________________________

Frank Clayton is Senior Research Fellow at Ryerson University's Centre for Urban Research and Land Development (CUR) in Toronto.

Daniel Bailey is a Research Assistant at Ryerson University's Centre for Urban Research and Land Development (CUR) in Toronto.