Another Look at the Room the City of Toronto Has to Raise Residential Property Taxes: Focus on Owner-Occupied Single-Detached Houses

By: Frank Clayton with research assistance provided by Candace Safonovs

March 28, 2019

The Centre for Urban Research and Land Development (“CUR”)’s recent research report, How Much Room Does the City of Toronto Have for Increasing Residential Property Taxes? (February 28, 2019), examined the property taxes paid by owner-occupants regardless of the types of housing occupied. Thus, the average property taxes paid; the effective tax rate (taxes as percent of average market value of owner-occupied homes); and the tax burden (taxes as percent of household income) in the 29 municipalities within the Greater Toronto and Hamilton Area (“GTHA”) reflected property taxes for a mix of housing types. This has analytical implications as the City of Toronto has many more condo apartments than do other municipalities.

This note concentrates on residential property tax rates for one housing type – single-detached houses – in order to conduct a fairer apples-to-apples comparison.

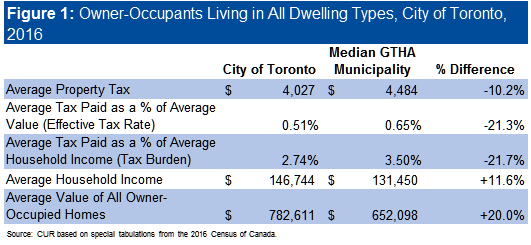

Figure 1 summarizes the comparison between the City of Toronto and the median-valued municipalities from the February report.

For all owner-occupants, the data show that Torontonians on average paid less in property taxes than the median-valued municipality (-10.2 percent), but had both higher average household incomes (+11.6 percent) and average home values (+20.0 percent). This resulted in Torontonians in 2016 being assessed an average effective tax rate and an average tax burden of some 21-22 percent less than the median municipality in the GTHA.

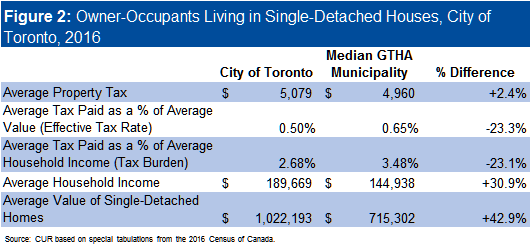

Figure 2 examines the same information filtered by tax rates assessed on single-detached houses. It shows that the average Torontonian paid a slightly higher property tax than did the residents of the median-valued municipality (+2.4%). However it also shows that the differential in the average household income and the average home price in Toronto as relative to the median-valued municipality has widened considerably to +30.9 percent and +42.9 percent, respectively. This results in an average effective tax rate and an average effective tax burden of 23.1-23.3 percent less for the City of Toronto than for the median-valued municipality in 2016.

CUR’s February 2019 report concluded that Toronto has room to increase its average property tax rate on owner-occupied homes by approximately 20% to fund infrastructure while still assessing residential property taxes in the middle of the range of taxes levied by 28 other municipalities within the GTHA. This conclusion still holds when the property tax assessments of owner-occupants of single-detached houses only are considered.

________________________________________________________________________

Frank Clayton is Senior Research Fellow at Toronto Metropolitan University’s Centre for Urban Research and Land Development (CUR) in Toronto.

_________________________________________________________________________________________________________